Pandemic continues to hit state

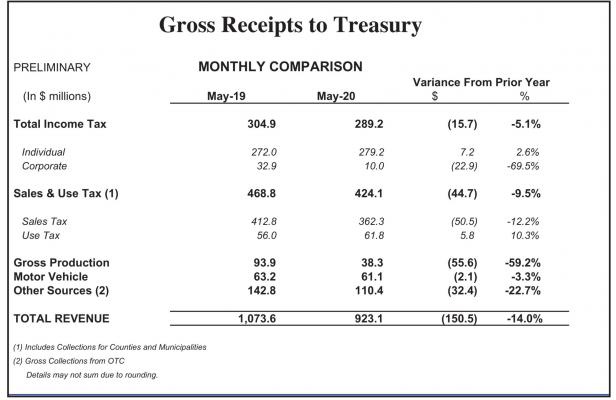

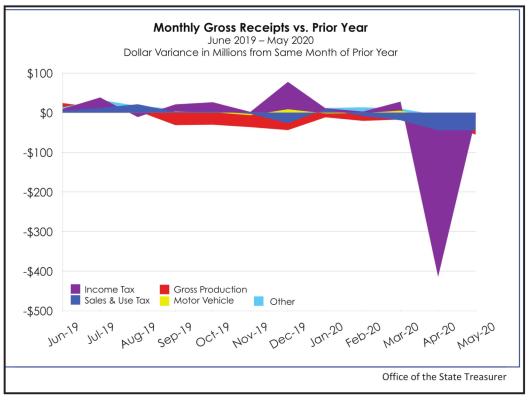

OKLAHOMA CITY — The coronavirus pandemic continued to make its presence known in this month’s Oklahoma Gross Receipts to the Treasury, State Treasurer Randy McDaniel announced as he released data showing a 14 percent drop in May revenue collections.

Gross receipts for May total $923.1 million, down by $150.5 million from May of last year.

“The Oklahoma economy, as reflected in state revenue collections, was significantly impacted by the pandemic during the month,” Treasurer McDaniel said.

“However, the picture in May is not as conspicuous as the April report, which included the postponement until July of income tax reporting.”

McDaniel pointed to a few positive numbers in the May report. Of the six major revenue sources tracked in gross receipts, two showed positive movement. Use tax, paid on out-of-state purchases including online, and individual income tax were both slightly higher than receipts from the prior year by a combined total of $13 million. On the other hand, sales

On the other hand, sales tax and gross production receipts were substantially lower by a combined total of $106.1 million.

Sales tax receipts, including remittances on behalf of cities and counties, fell by more than 12 percent over the year. Gross production collections were down by almost 60 percent compared to last May.

May gross production tax receipts are paid on crude oil and natural gas production during March, when the price per barrel of West Texas Intermediate Crude Oil at Cushing averaged $29.21. One year ago, the average price was $58.15 per barrel. Meanwhile, natural gas prices fell by almost 40 percent over the year.

Total gross receipts from the past 12 months are $13.07 billion, off by $477.1 million, or 3.5 percent, compared to the previous 12 months. Shrinking income, sales and gross production tax collections exhibited the most downward pressure during the period.

Economic Indicators

The unemployment rate in Oklahoma was reported as 13.7 percent in April, up from 2.9 percent in March. The seasonally adjusted number of Oklahomans listed as jobless increased by 188,950 in one month, according to figures released by the Oklahoma Employment Security Commission. The U.S. unemployment rate was 14.7 percent in April.

The Oklahoma Business Conditions Index increased slightly in May, but remained in negative territory. The May index was set at 43.0, up from 34.2 in April. Numbers below 50 indicate economic contraction is expected during the next three to six months.

May Collections

May gross collections total $923.1 million, down by $150.5 million, or 14 percent, from May 2019.

Gross income tax collections, a combination of individual and corporate income taxes, generated $289.2 million, a decrease of $15.7 million, or 5.1 percent, from the previous May.

Individual income tax collections for the month are $279.2 million, up by $7.2 million, or 2.6 percent, from the prior year. Corporate collections are $10 million, a decrease of $22.9 million, or 69.5 percent.

Combined sales and use tax collections, including remittances on behalf of cities and counties, total $424.1 million in May. That is $44.7 million, or 9.5 percent, less than May 2019.

Sales tax collections in May total $362.3 million, a drop of $50.5 million, or 12.2 percent from the same month of the prior year. Use tax receipts, collected on outof-state purchases including online sales, generated $61.8 million, an increase of $5.8 million, or 10.3 percent, over the year.

Gross production taxes on oil and natural gas total $38.3 million in May, a decrease of $55.6 million, or 59.2 percent, from last May. Compared to April 2020 reports, gross production collections are down by $22.4 million, or 36.9 percent.

Motor vehicle taxes produced $61.1 million, down by $2.1 million, or 3.3 percent, from the same month of 2019.

Other collections composed of some 60 different sources including taxes on fuel, tobacco, medical marijuana, and alcoholic beverages, produced $110.4 million during the month. That is $32.4 million, or 22.7 percent, less than last May.

Twelve-Month Collections

Gross revenue totals $13.07 billion from the past 12 months, June 2019 through May 2020. That is $477.1 million, or 3.5 percent, below collections from the previous 12-month period.

Gross income taxes generated $4.37 billion for the 12 months, reflecting a decrease of $225.5 million, or 4.9 percent, from the prior 12 months.

Individual income tax collections total $3.86 billion, down by $202 million, or 5 percent, from the prior period. Corporate collections are $501.8 million for the period, a decrease of $23.5 million, or 4.5 percent, over the previous 12 months.

Combined sales and use taxes for the 12 months generated $5.47 billion, a decrease of $95.4 million, or 1.7 percent, from the prior period.

Gross sales tax receipts total $4.74 billion, down by $161.6 million, or 3.3 percent, during the period. Use tax collections generated $735.6 million, an increase of $66.2 million, or 9.9 percent, over the previous 12 months.

Oil and gas gross production tax collections brought in $901.7 million during the 12 months, down by $227.4 million, or 20.1 percent, from the previous 12 months.

Motor vehicle collections total $776.1 million for the 12 months. This is a decrease of $8.3 million, or 1.1 percent, from the trailing period. D

Other sources generated $1.55 billion, $100 up by $79.5 million, or 5.4 percent, from the previous period.

About Gross Receipts to the Treasury $0

The $0 monthly Gross Receipts to the Treasury report, developed by the state treasurer’s office, pro--$100 vides a timely and broad view of the state’s economy.

It is released in conjunction with the General Revenue Fund report from the -$200 Office of Management and Enterprise Services, which provides information to state agencies for budgetary planning purposes. -$300

The General Revenue Fund, the state’s main operating account, receives less than half of the state’s gross -$400 receipts with the remainder paid in rebates and refunds, remitted to cities and Income counTaties, and apportioned Sales & to Us other state funds.